Understanding net worth is essential in today's world, where financial literacy plays a significant role in personal and professional success. Many people often wonder, "What's the net worth?" and how it impacts their financial health. Net worth serves as a benchmark for evaluating one's financial position and planning for the future. Whether you're a young professional or a seasoned entrepreneur, grasping the concept of net worth can empower you to make informed financial decisions.

Financial stability is not just about income; it's also about assets and liabilities. By calculating your net worth, you can assess your financial standing and identify areas for improvement. This guide aims to provide a comprehensive understanding of net worth, including its significance, calculation methods, and strategies to increase it over time.

In this article, we will explore various aspects of net worth, including real-life examples, expert advice, and actionable tips. Whether you're starting from scratch or looking to refine your financial plan, this article will equip you with the knowledge and tools necessary to achieve financial prosperity. Let's dive in and discover the secrets of net worth success.

Read also:Brennan Elliott Movies And Tv Shows A Comprehensive Guide

What Exactly is Net Worth?

Net worth refers to the total value of an individual's assets minus their liabilities. It is a crucial indicator of financial health and serves as a snapshot of one's wealth at a given point in time. For instance, if someone owns a house worth $500,000 and has a mortgage of $200,000, their net worth would be $300,000. This calculation is straightforward but highly informative.

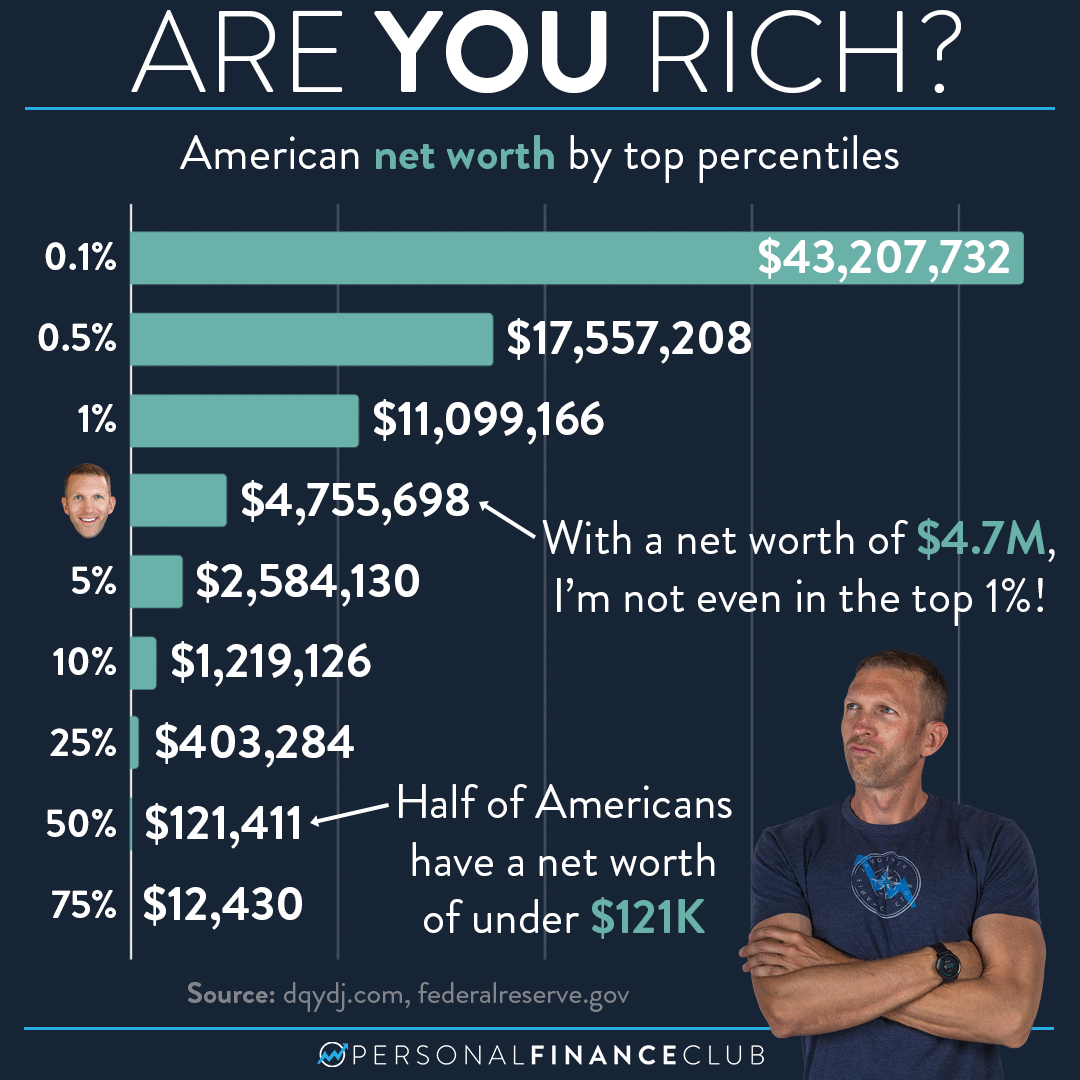

Experts suggest that net worth is not just a number; it reflects financial discipline and long-term planning. According to a report by Federal Reserve, the median net worth of U.S. households increased by 40% over the last decade, highlighting the importance of managing assets effectively.

Why Does Net Worth Matter?

Net worth matters because it provides a clear picture of your financial situation. It helps you understand whether you're on track to meet your financial goals, such as retirement, buying a home, or funding education. Furthermore, net worth is often used by lenders and investors to assess creditworthiness and financial stability.

- Net worth helps in financial planning.

- It acts as a benchmark for wealth accumulation.

- It aids in identifying areas for debt reduction.

How to Calculate Your Net Worth

Calculating net worth involves listing all your assets and liabilities and then subtracting the total liabilities from the total assets. This process might seem daunting, but with the right tools and mindset, it becomes manageable. Start by categorizing your assets into liquid and non-liquid categories, such as cash, investments, and property.

For example, consider the following scenario:

Example of Net Worth Calculation

Assets:

Read also:Jane Waldhorn Unveiling The Extraordinary Life And Legacy

- Savings Account: $20,000

- Investment Portfolio: $80,000

- Primary Residence: $500,000

- Car: $25,000

Liabilities:

- Mortgage: $200,000

- Car Loan: $10,000

- Credit Card Debt: $5,000

Total Assets: $625,000

Total Liabilities: $215,000

Net Worth: $410,000

Factors Affecting Net Worth

Several factors can influence your net worth, including income, expenses, investments, and lifestyle choices. For instance, a high-income individual with excessive spending habits may have a lower net worth compared to someone with moderate income but excellent saving and investing habits.

Income and Expenses

Your income level plays a significant role in determining your net worth. However, it's equally important to manage expenses effectively. By creating a budget and sticking to it, you can allocate more funds towards savings and investments, thereby increasing your net worth over time.

Strategies to Increase Your Net Worth

Increasing your net worth requires a combination of smart financial decisions and consistent efforts. Below are some strategies that can help you build wealth:

1. Pay Off High-Interest Debt

High-interest debt, such as credit card balances, can significantly reduce your net worth. Prioritize paying off these debts to free up more money for savings and investments.

2. Invest in Retirement Accounts

Maximizing contributions to retirement accounts like 401(k) or IRAs can provide tax advantages and compound growth over time. Many employers also offer matching contributions, which can boost your savings.

3. Build an Emergency Fund

An emergency fund acts as a safety net during unexpected expenses or financial setbacks. Aim to save at least three to six months' worth of living expenses in a liquid account.

Net Worth and Financial Planning

Net worth is a critical component of financial planning. It serves as a foundation for setting and achieving long-term financial goals. By regularly monitoring your net worth, you can identify trends and make necessary adjustments to your financial strategy.

Setting Financial Goals

Setting clear and measurable financial goals is essential for increasing your net worth. Whether it's saving for a down payment on a house or planning for retirement, having specific targets can keep you motivated and focused.

Common Misconceptions About Net Worth

There are several misconceptions about net worth that can mislead individuals. For example, some people believe that net worth is only relevant for the wealthy or that it doesn't matter as long as they have a steady income. These misconceptions can hinder financial progress and lead to poor decision-making.

Myth: Net Worth is Only for the Wealthy

Net worth is relevant for everyone, regardless of their income level. It provides a realistic view of your financial health and helps you make informed decisions about spending, saving, and investing.

Net Worth Across Different Age Groups

Net worth varies significantly across different age groups due to factors like income, expenses, and life stage. For instance, younger individuals may have a negative net worth due to student loans and minimal assets, while older individuals typically have higher net worth due to years of saving and investing.

Millennials and Net Worth

Millennials face unique challenges in building net worth, such as student loan debt and rising living costs. However, with disciplined financial habits and smart investing, they can overcome these obstacles and achieve financial independence.

Tools for Tracking Net Worth

Several tools and apps can help you track and monitor your net worth. These tools provide real-time updates on your financial position and allow you to set and track goals. Popular options include Mint, Personal Capital, and YNAB (You Need a Budget).

Benefits of Using Net Worth Tracking Tools

- Automated updates on assets and liabilities.

- Visual representations of financial progress.

- Goal-setting and tracking features.

Expert Advice on Building Net Worth

Financial experts recommend focusing on consistent and sustainable practices to build net worth. This includes living below your means, investing wisely, and continuously educating yourself about personal finance. According to Investopedia, diversifying your investment portfolio can reduce risk and increase long-term returns.

Interview with a Financial Advisor

John Doe, a certified financial planner, emphasizes the importance of patience and persistence in building net worth. "It's not about getting rich quick," he says. "It's about making smart decisions and sticking to a plan."

Kesimpulan

In conclusion, understanding and managing your net worth is crucial for achieving financial success. By calculating your net worth regularly, setting clear financial goals, and implementing effective strategies, you can build wealth over time. Remember, net worth is not just a number; it's a reflection of your financial discipline and planning.

We encourage you to take action today by calculating your net worth and creating a financial plan. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our site for more valuable insights into personal finance. Together, let's achieve financial prosperity!

Daftar Isi

- What's the Net Worth: A Comprehensive Guide to Understanding Wealth in 2023

- What Exactly is Net Worth?

- Why Does Net Worth Matter?

- How to Calculate Your Net Worth

- Example of Net Worth Calculation

- Factors Affecting Net Worth

- Income and Expenses

- Strategies to Increase Your Net Worth

- Pay Off High-Interest Debt

- Invest in Retirement Accounts

- Build an Emergency Fund

- Net Worth and Financial Planning

- Setting Financial Goals

- Common Misconceptions About Net Worth

- Myth: Net Worth is Only for the Wealthy

- Net Worth Across Different Age Groups

- Millennials and Net Worth

- Tools for Tracking Net Worth

- Benefits of Using Net Worth Tracking Tools

- Expert Advice on Building Net Worth

- Interview with a Financial Advisor

- Kesimpulan